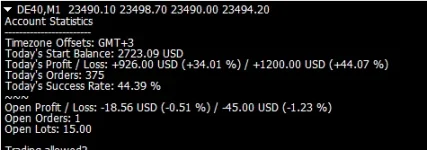

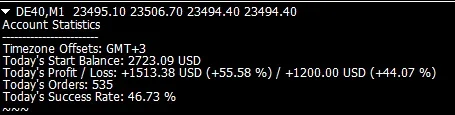

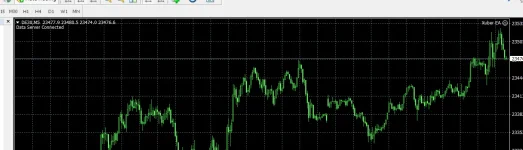

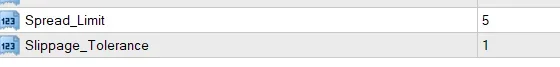

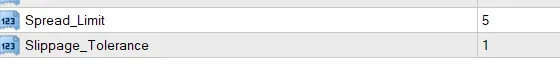

Yeah its demo, I made adjustments on the spreads and slippage.. I also added a max drawdown on open trades, for every 1 lot, max drawdown is 3$ when the other equity manager EA manually closes without adjusting the initial entry stop.. I noticed high slippage on highly volatile times which seems to be a setback too. on a 15 lot, 45$ drawdow, it closes between 50 and 100$ lose.. If I was to lower the max drawdown on a trade to lets say 1$ per lot that is also still affected.. The more trades it takes in volatile point in time the significant the overall drawdown and less profitable. I find its best to set a max profit threshold to disable EA from placing more orders.. 10% is achievable if you use hedging rr. ofcourse am testing on demo and its all hypothetical.

View attachment 3794